Armenia 2024

Executive summary

Purpose and management

The purposes of the assessment were:

to establish a new baseline for the performance of the Armenian PFM system using the 2016 PEFA Framework, bearing in mind that the previous assessment reported in 2014 under the 2011 Framework;

to inform and guide the development of a new PFM Reform Strategy and Action Plan for the five-year period 2024 -28;

to highlight the key strengths and weaknesses of the PFM system;

to provide a basis for continuing capacity development in PFM.

On behalf of the GoA, the Ministry of Finance has expressed and shown its strong commitment to using the findings of the PEFA Assessment to inform and guide the continuing process of PFM reform and modernisation in Armenia. The essential prioritisation and sequencing of activities that will be reflected in the Reform Strategy and Action Plan will be supported by both the scoring of the PEFA indicators and, arguably, more importantly, by the discussion of PFM issues contained in the PEFA Report

Strategic management and oversight of the Assessment has been carried out by the PEFA Steering Committee, which comprises representatives of the Ministry of Finance of the Republic of Armenia Government, the European Union Delegation, the French Agency for Development. the Asian Development Bank, the World Bank and the International Monetary Fund. The lead agency was the European Union, represented by Mr. Frank Hess, Head of Cooperation and Ms. Zuzana Sorocinova, Programme Officer. The EUD, as primary funding agency, chairs the Committee.

Whilst the primary entity responsible for RA Government’s oversight of the Assessment was the Ministry of Finance, there are several other key Armenian institutional stakeholders who have had an active involvement with the Assessment, including the Audit Chamber, the State Revenue Committee, the State Property Management Committee, the National Assembly and several civil society organisations. In order to optimize participation and ownership of the Assessment, therefore, there has been, at the operational level, an Oversight Committee chaired by the Ministry of Finance. In addition, there has been regular and highly beneficial, dialogue between the assessment team and the Adviser to the Minister of Finance both during and between in-country missions.

As is customary with PEFA assessments the report does not contain any specific PFM reform recommendations. Instead, the Assessment should be seen as a vehicle for guiding Governments in their determination of short- and longer-term actions that contribute to the achievement of their planned PFM outcomes.

.

Main strengths and weaknesses of the PFM systems in Armenia

Armenia’s PFM systems show a number of significant strengths, including:

Effective aggregate expenditure control;

An overall high level of fiscal transparency;

Sound macro-fiscal planning and management;

Efficient tax administration;

Well-performing accounting and reporting systems;

At the same time, certain weaknesses have been identified, namely:

Incomplete information on planned tax revenues composition;

An excessive number of programmes and measures with limited focus on outcomes;

Disconnections between strategic planning and budget preparation;

Shortcomings in capital investment appraisal, implementation and monitoring;

Confused and inconsistent internal audit arrangements;

Limited independent evaluation of government service delivery programmes.

More broadly, as far as aggregate financial discipline is concerned, the PFM system in Armenia has demonstrated its ability to plan and contain expenditure within available resources despite the shocks that the country has experienced in the last three years.

Some of the necessary foundations for effective resource allocation through strategic planning of services and medium-term fiscal planning are in place at the macro level and at the level of individual budget bodies. Medium-term and annual budgeting practices are generally sound and efficiently implemented, though there are weaknesses in the links between strategic plans and resource allocation. There is room for improvement in the quality - and in some cases relevance – of the performance indicators and targets which are set for public service provision. There is also a lack of connection between projected expenditure levels in the MTEF and the starting baseline for budget preparation.

Several initiatives under way may contribute to greater efficiency and effectiveness in the use of public resources. It is particularly encouraging to note that the GoA is paying close attention to the delivery of a wide range of public services: as evidenced by the recent reforms in programme and performance-based budgeting. It has also been experimenting with the partial contracting out of internal audit services to the private sector in pursuit of improved financial and operational efficiency though the effectiveness of this approach has been uneven. Essentially the internal audit arrangements are still evolving. The Audit Chamber also contributes to improvements in public services through its performance audit work and the use of independent consultants to evaluate government programmes is being trialled.

Armenia has been receiving support from the international development community towards the improvement of public financial management (PFM) for a number of years, some of which has been provided by means of EU budget support. EU assistance has generally been partly conditional on the maintenance of macro-economic stability, the implementation of a continuing program of public financial management (PFM) reform, and further improvements in the transparency of PFM. This assessment, which was sponsored by the EU and the ADB, is intended to provide an overview of progress in PFM since the previous assessment that reported in 2014 under the 2011 PEFA Framework, and at the same time to establish a benchmark for the future measurement of progress. The assessment will inform and guide the development of a new PFM Reform Strategy and Action Plan for the five-year period 2024 -28; highlight the key strengths and weaknesses of the PFM system; and provide a basis for continuing capacity development in PFM.

The assessment focuses on budgetary central government (BCG) – this means the 46 main budget bodies and 68 subordinate bodies, City of Yerevan and about 1800 SNCOs that taken together, comprise the central government in Armenia.

Armenia has faced a very challenging social, economic, political and security environment during the period covered by this assessment (2020-22). Three major exogenous shocks affected the country, namely the COVID-19 pandemic, armed conflict with neighbouring Azerbaijan and the regional insecurity associated with the Russian invasion of Ukraine. Despite these shocks, the IMF reports that, after falling by 7.2% in 2020, real GDP grew by 5.7% in 2021 and 12.6 percent in 2022, “driven by robust consumption and a surge in inflow of income, capital, business, and labour”.

In terms of the public finances, the IMF notes that, by the end of the period under review in 2022, Armenia had succeeded in improving its fiscal position significantly. The headline fiscal deficit narrowed to 2.1 percent of GDP in 2022 on account of robust revenues and spending under-execution. Central government debt dropped by 14 percentage points of GDP to 46.7 percent of GDP, due to deficit reduction, high nominal growth, and exchange rate appreciation.

In the field of PFM, Armenia has been undertaking a wide range of developments under its PFM Reform Strategy 2019-23. These include the introduction of programme budgeting and the gradual application of accrual accounting principles to government financial statements. An interesting approach to the resourcing of government internal audit has been introduced whereby most of the larger budget bodies have contracted out the service to the private sector, albeit with different perceptions of the degree of success in the eyes of government officials

This assessment shows that Armenia has generally been able to maintain aggregate fiscal discipline, with effective cash and debt management, and prompt and accurate budget execution reporting. Aggregate expenditure has been kept within budgeted amounts, although there have been fluctuations in the balance between recurrent and capital expenditure and between functions. There have also been significant variances between aggregate revenue forecast and the outturn as well as fairly large variances in the composition of revenue. Payroll control and procurement management are generally satisfactory.

Considerable efforts have been made to improve the strategic allocation and management of resources, through the use of programme performance indicators against which actual achievements are measured. However, the indicators are mostly financial or defined in terms of outputs or activities rather than outcomes in terms of service improvements. Budget documentation does not seem to provide any clear indication of the link between the actions to be undertaken and the achievement of specified outputs, let alone outcomes. Institutional arrangements in the form of the Government Programme and the High-Level Investment Committee chaired by the Prime Minister do provide a framework within which specific decisions on capital investments or other actions to achieve service improvements should be based. However, there are not, as yet, strong linkages between these strategic plans and budget allocation. Efforts supported by the World Bank, IMF and ADB to strengthen public investment management should enable improvements to project appraisal, implementation and monitoring but the impact of these arrangements will be optimized only if the links between strategic plans and actual decisions are strengthened.

Good scores on PFM Indicators do not necessarily show that resources are used efficiently for service delivery. It is important to ensure that a focus on correct procedures being followed is not at the expense of good performance in providing public services. In this context it is encouraging that there are continuing efforts to improve the balance of external audit work away from compliance towards systems and performance. There is an important role here too for internal audit where the effectiveness of a contracted-out approach is under review by the Ministry of Finance.

Overall, the picture is of continuing gradual improvement in PFM across a range of important issues despite a very volatile socio-economic and political environment compounded by national security concerns. Financial management information systems have improved, and important work is taking place on the development and implementation of a multi-module Government Financial Management Information System (GFMIS) that is intended to provide a fully automated budget planning process connected to accounting units and facilitate more efficient expenditure management. From the perspective of transparency, a great deal of fiscal information is published promptly.

There are good prospects for continuing improvements in PFM, supported by Armenia’s international development partners. A new five-year PFM reform strategy is to be developed covering the five years 2024-28. Whilst this will be informed by the current PEFA assessment, it will be important for the RA Government to choose priorities carefully so as not to exceed the capacity of the PFM system to absorb reform demands.

Performance changes since the previous PEFA assessment

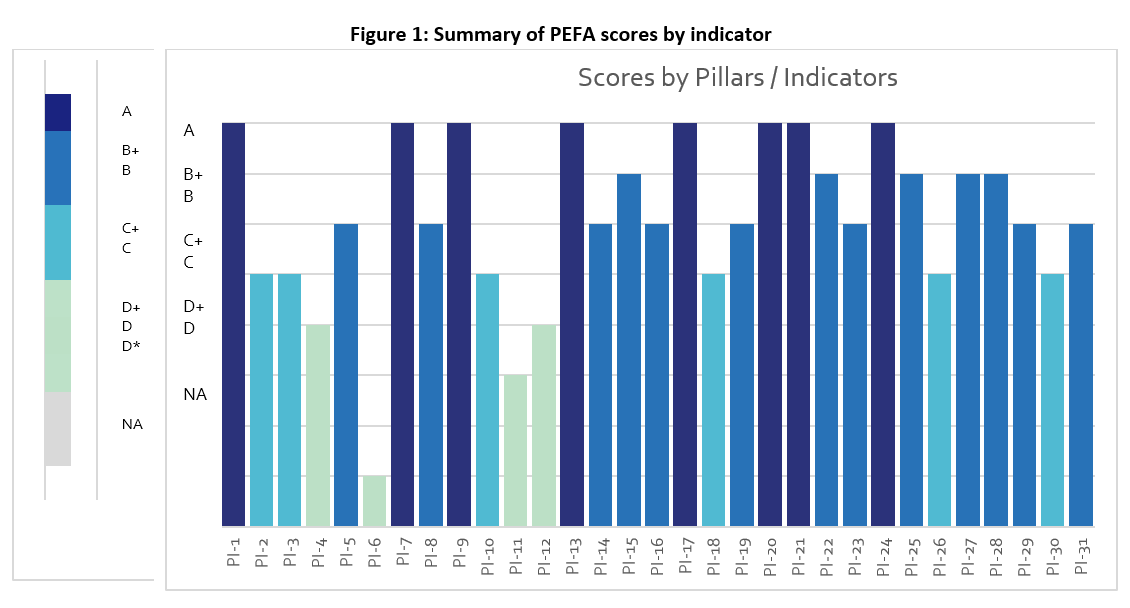

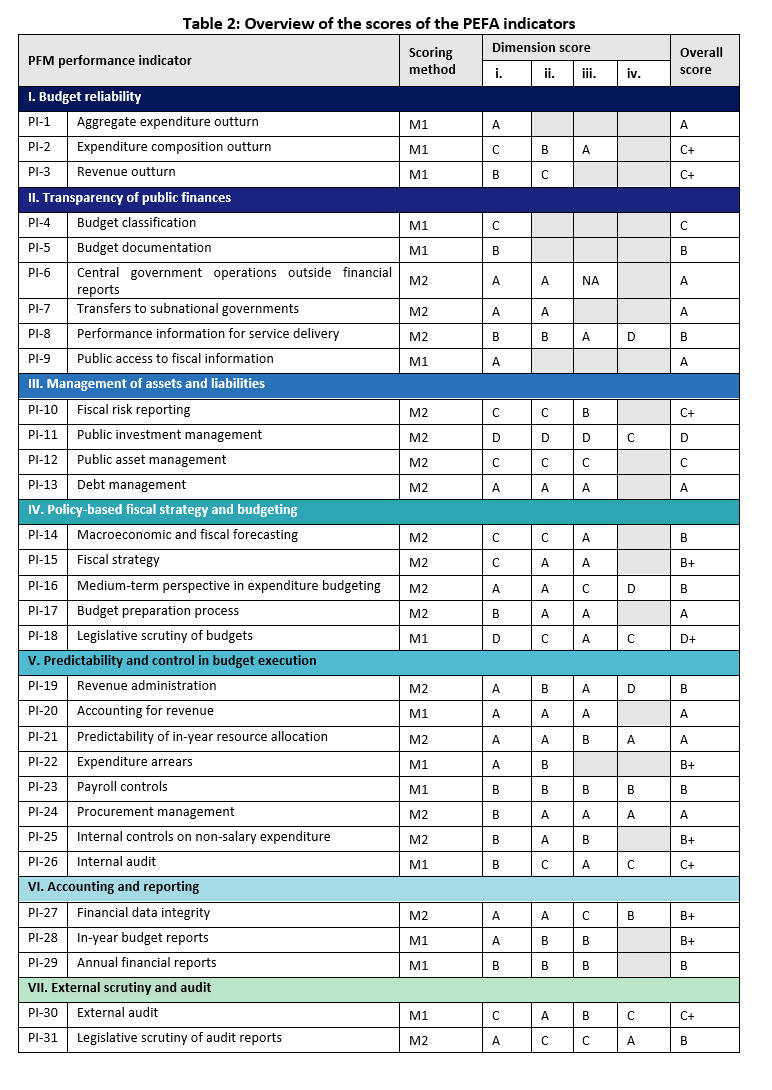

The last PEFA assessment was conducted in 2013, using the 2011 methodology. Annex 4 provides a detailed analysis of changes since that time. Overall, this reveals a positive situation. The majority (61%) of the PFM areas have not changed and nearly # one third (29%) achieved higher PEFA scores in 2023.

The areas of improvement include the process of capturing all central government operations of budgetary and the former extra-budgetary (SNCOs) activities allowing a complete picture of expenditure and revenue in the annual budget execution reporting. This contributes to more comprehensive budget reporting and better transparency.

Another positive development is in the area of transparency of taxpayer obligations and liabilities with clearer tax procedures and regulation. Payroll control has become more rigorous by having monthly reconciliation between the staff list and the payroll that results in lack of retroactive adjustments. Fiscal discipline is strengthened by having the personnel data and payroll data linked so that changes are reflected each month.

The strengthening of the internal control system is evidenced also by having more effective internal controls of non-salary expenditure.

There is now greater functioning of internal audit, some of which has been contracted out to the private sector. There has been improvement in the quality of the annual financial statements through the application of the majority of international accounting standards (PI-25 scored B from D+) adopted as APSAS. Overall these improvements have contributed to the predictability and control in budget execution.

The three areas where the performance declined are: (i) PI-1 scored B from A due to higher variance in aggregate expenditure out-turn compared to the approved budget; (ii) PI-3 scored C from A for higher variance in aggregate revenue out-turn compared to the approved budget; (iii) significant amounts of uncleared advance account balances at year-end that affects the timeliness and regularity of accounts reconciliation.

With regard to the three budgetary outcomes. aggregate fiscal discipline is supported by:

sound operation of procedures forecasting expenditure commitments and providing reliable information on the availability of funds that would maintain smooth resource allocation throughout the year

Good internal controls on expenditure commitments and compliance with payment rules to ensure that public funds are spent as planned.

Reliable fiscal discipline with no incurred expenditure arrears and effective debt management.

The strategic allocation of resources are evidenced by:

improved government‘s ability to predict and collect revenue,

absence of unreported government operations,

monitoring of subnational governments with transparent financial information.

On the other hand, public investment management and public asset management are both in need of further development.

Efficient service delivery in the operations of the government finances is demonstrated by

the improved public procurement practice with the prevailing competitive method;

expanded coverage of internal audit;

better quality of the financial accounting statements

However, there remains a need to do more to strengthen the independent evaluation of service deliver programmes.

Impact of PFM performance on budgetary and fiscal outcomes

This section of the report considers the ways in which PFM performance impacts upon the key budgetary and fiscal outcomes. The first outcome is aggregate fiscal discipline. In this area Armenia has done well in managing public expenditure during a period of great economic, security and social instability. This achievement is indicated by the A score awarded to PI-1 which addresses the aggregate expenditure outturn and also by the absence of use of contingency funding (PI-2.3). Revenue administration has also performed well at the aggregate level. In terms of both expenditure and revenue there has been a premium on a certain amount of flexibility given the effects of COVID, armed conflict on the border and the Russian invasion of Ukraine. This has resulted in significant variances in the composition of expenditure and revenue.

The second outcome concerns the strategic allocation of resources where overall performance has been rather mixed. Although a programmatic approach to expenditure planning and reporting has been in place since 2019, the linkages between long-term national development goals, medium-term sector strategies and plans and budgets remain weak. There have been particular problems regarding the planning, execution and monitoring of capital expenditure projects, though there are signs that public investment and public asset management reforms are in progress.

The final outcome concerns efficient service delivery. Here some of the necessary architecture for public service management is in place. There is a framework of performance indicators that is used to measure and monitor service delivery but the process suffers from a surfeit of indicators that are heavily focused on financial inputs rather than service outputs, and especially outcomes. Independent performance evaluation is in its infancy though the Chamber of Audit does undertake performance audits and a number of programme evaluations are being trialled. There is a role too for a strengthened internal audit function across Government where current practice is in need of strengthening. Accounting reform is under way focused on the application of accruals methodology intended to provide the basis for better resource allocation and management.