Greenland 2021/AGILE REPORT/

This report presents the findings of the Greenland Agile PEFA assessment 2021. The preparation of the draft report has made use of the PEFA Secretariat’s “Agile PEFA: An approach for streamlining PEFA assessments – Guidance for assessors, August 2020” as well as the PEFA Secretariat’s “PEFA Handbook – Volume II: PEFA Assessment Field Guide, December 2018”.

Country context

Government

Since 1979 Greenland has been a parliamentary democracy within the Kingdom of Denmark (self-governing territory) ruled by the Government of Greenland (GoG – Naalakkersuisut). Greenland was part of the European Community since 1973 through Danish Membership, however, Greenland formally withdrew from the European Community in 1985. Subsequently Greenland became one of the Overseas Country and Territories associated with the European Union in accordance with Part IV of the Treaty on the Functioning of the European Union, since the entry into force of the Greenland Treaty on 1 February 1985.

Economy

Greenland is the world’s largest island and a remote territory with a small population of 56,421[1] in 2021 and a per capita income of DKK 362,000[2] in 2020 (€ 48,721 or US$ 55,692). The evolution in real GDP growth is depicted in figure 1.1. COVID 19 has added additional uncertainty to growth estimates. The Greenland Economic Council (GØR) in their Spring 2020 forecast in addition to the base forecast prepared additional scenarios for the GDP growth under different assumptions with regards to the effect of COVID 19.

Figure 1.1: Real GDP growth (%) and added forecast uncertainty during COVID 19

Data source: GØR reports

However, the GØR 2020 Autumn forecast and the GØR 2021 Spring forecast estimated that the Greenland economy will not be as hard hit as initially feared in the alternative scenarios, partly due to the support packages together with sanitary restrictions implemented by the GoG. Select key economic indicators are presented in table 1.1.

Table 1.1: Selected key economic indicators

|

|

2018 |

2019 |

2020 |

|

GDP (2010=100) in million |

15,267 |

15,523 |

15,663* |

|

GDP per capita (current prices) in thousand |

243.6 |

355.2 |

362.0 |

|

Currency: DKK |

|

|

|

|

GDP growth (%) |

1.8 |

2.3 |

0.9* |

|

CPI (annual avg. change %) |

0.6 |

2.4 |

0.2 |

|

Gross government debt (% of GDP) |

0.9 |

0.7 |

0.6 |

|

External terms of trade (annual % change) |

1.2 |

-2.5 |

Not available |

|

Current account balance (% of GDP[1])

|

-4.5 |

-5.5 |

-2.0 |

[1] GDP in current prices

Data Source: GØR, MoF and Greenland statistics

* Preliminary figure

Fiscal trends

Table 1.2 shows the overall fiscal trends in Greenland.

Table 1.2: Fiscal trends

|

All figures in million DKK |

2021 |

2022 |

2023 |

|

Total revenue |

7,119.6 |

7,166.0 |

7,204.3 |

|

Own revenue |

2,943.2 |

2,989.6 |

3,027.9 |

|

Grants |

4,176.4 |

4,176.4 |

4,176.4 |

|

Total expenditure |

7,185.6 |

7,141.1 |

7,137.9 |

|

Non-interest expenditure |

7,171.6 |

7,127.0 |

7,123.7 |

|

Interest expenditure |

-14,0 |

-14,1 |

-14,2 |

|

Aggregate deficit (incl. grants) |

-66,0 |

24,9 |

66,4 |

|

Primary deficit |

-66,0 |

24,9 |

66,4 |

|

Net financing |

0,0 |

0,0 |

0,0 |

Data source: FL2021

The Greenland Budget and Accounts Act of 2016 requires fiscal balance over a 4-year period. Figure 1.2 shows that GoG has been running a surplus on the primary fiscal balance (DA-balance) until 2019. Based on early 2020 estimates (see figure 1.2) the budget proposal for 2021 (FFL2021) foresaw a significant negative impact of COVID 19 on the primary fiscal balance compared to earlier estimates in the enacted 2020 budget (FL2020). However, in the enacted budget (FL2021) the negative effect had been revised due to an improved fiscal outlook in the autumn of 2020.

Figure 1.2: Real and forecasted evolution in the primary fiscal balance (DKK million)

Data source: Ministry of Finance

Note: Figures in FFL 2021 and FL 2021 presents updated figures on 2019 and outer years compared to FL 2020.

Looking to the longer-term GOG will have to carry out further reforms to achieve fiscal balance and sustainability of public finances. GØR has estimated[4] that – amongst others – shift in the Greenland demographics will increase public expenditure with between 5-6 % of the GDP. Unchecked this will lead to a deficit in the primary fiscal balance of approximately 1bn DDK over the next 10-15 years. Considering that public expenditure constitutes approximately 60 % of GDP and that 40 % of the workforce is employed in the public sector accentuates the need for a sustainability plan and for improved management of the various sectors in the GoG to guide prioritization of resource allocation in the public sector in coming years[5].

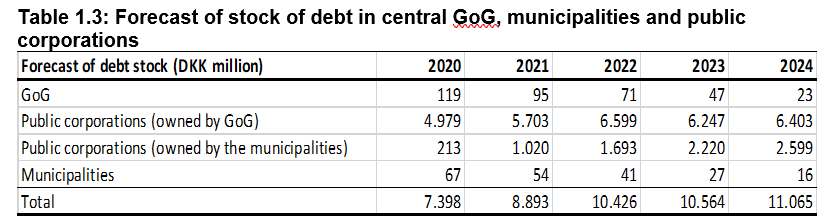

Table 1.3: Forecast of stock of debt in central GoG, municipalities and public corporations

Table 1.3: Forecast of stock of debt in central GoG, municipalities and public corporations

Data source: Ministry of Finance, 2021

Table 1.3 shows the forecasted development of the public stock of debt. It is noted that GoG during 2020 had a liquidity position of approximately 1.2bn. While GoG and the municipalities carry an insignificant amount of debt, a growing stock of debt is carried by public corporations owned by GoG and the municipalities. This underscores fiscal risks are increasing and must be managed by GoG.

Rationale and purpose of the assessment

The objective of the Greenland Agile PEFA assessment 2021 is to measure the current performance of public financial management systems using an objective, internationally recognized standard. This assessment identifies the key weaknesses in public financial management and the main underlying causes. It also tracks public financial management performance against the most recent formal PEFA assessment from 2014 in accordance with the PEFA Secretariat’s guidance. The assessment will contribute to improved quality, transparency, accountability, and effectiveness of public finance management in Greenland. The first PEFA assessment was carried out in 2008.

The assessment will further be used to assess progress on Greenland current public financial management reform action plan, and will serve as a basis to develop suggested elements in an updated public financial management reform action plan of Greenland for 2021-2024, including proposal of a set of objectives and indicators to measure progress against the action plan.

Assessment management and quality assurance

The assessment team was led by Mr. Søren Langhoff (DT Global) and included Mr. Frans Hesse (DT Global) and Mr. Halfdan Pedersen (DT Global). Quality assurance has been carried out by the PEFA Secretariat.

Further details on the assessment management and quality assurance arrangements are presented in Annex

Methodology

The PEFA assessment was undertaken in accordance with the PEFA 2016 methodology using the pilot Agile PEFA approach. The assessment covers 31 indicators and 94 dimensions. The SNG sector of Greenland is constituted by 5 municipalities. Annex 6 tracks performance of selected indicators since the previous PEFA assessment in 2014 using the 2011 framework. The mapping of the 2014 assessment to the 2021 assessment has been carried out guided by the PEFA Secretariat’s mapping table “PEFA 2016 vs. 2011 at a glance”.

Field work was carried out remotely due to COVID 19 related travel restrictions.

Scope and coverage

The scope of the PEFA assessment covers the central government, i.e. entities receiving budget allocations from the central government’s budget including 10 ministries and a total 68 budgetary units (line ministries and agencies). There are no units that are classified as extrabudgetary units. No extrabudgetary operations have been identified. Several public enterprises are due to the definitions in the GFSM 2014 classified as Public Corporation and outside of Central Government. A total of 14 Public Corporations have been considered with regards to the fiscal risk they present to the GoG. A list of the ministries covered by the assessment is presented at Annex 2.

PFM legal framework

Public financial management at central and municipal level is regulated by the Budget and Accounts Act 2016 and the Budget Regulation 2008. The Budget and Accounts Act 2016 provides the legal framework for audit activity. The Tax Agency is an agency under the MoF vested with the responsibility to administer the tax code. The tax code is constituted by a number of individual Acts. Additional legislation covers Procurement for both public works (Law nr. 6 of June, 2019, and Circular of October 20, 2020, on Public procurement of goods and services and Law nr. 11 of December 2, 2009, on Public Work tenders.

Time period

The assessment is based on the following timelines:

|

Time period and time lines |

|

|

Remote field work |

August 12, 2021 – September 2, 2021 |

|

Country fiscal year |

January 1 to December 31 |

|

Last three fiscal years covered |

FY 2018, 2019 and 2020 |

|

Latest budget submitted to legislature |

FY 2021 |

|

Time of assessment (planned cut-off) |

September 2, 2021 |

Sources of information

The assessment team consulted a wide range of documents from various sources including government ministries, independent councils and consultancy reports. Evidence used is highlighted for each indicator and dimension. Where this information is available publicly on the government website or other trustworthy websites the relevant link is noted. A consolidated list of documents used for this assessment, including by indicator, can be found in Annex 3. The names of all persons interviewed are listed in Annex 4.

Summary of Findings

2.1 PFM strengths and weaknesses

The PFM system is mature, well-functioning and continues to develop. With the full introduction of the new ERP in the public sector, the GoG and the municipalities, coupled with a revised Chart of Accounts (CoA), budget planning and execution are streamlined and credible evidenced by just 1%-1.6% annual variations.

The ERP used in GoG is named PRISME and encompasses a number of relevant modules covering PFM work flows in GoG. PRISME includes modules providing support to General Ledger, budget execution of revenue and expenditure, reporting and accounting, electronic payments processing, payroll and a number of other functionality areas.

Although the budget presentation is comprehensive and aligned with COFOG, the presentation of the macro-fiscal framework could be improved, including assumptions and analysis of alternative scenarios. Also, the preparation of sector plans and the use of sector plans in conjunction with adopting an improved medium-term perspective on budgeting presents opportunities to improve public understanding of the budget planning process with better information on service delivery and outcomes. The budget calendar is fully respected, and there is a high degree of transparency of fiscal information available to the public on the GoG websites.

While GoG fiscal risks in terms of contingent liabilities are well reported and also individually by the corporations in the published annual audited financial statements, the overall financial risk scenario would be incomplete, if not consolidated reported. Though the GoG has a positive debt position, it has significant risk exposure as the sole owner of the 14 corporations with a total net interest-bearing debt of 4bn and likely to increase. This should to be taken into account when considering the potential impact on the fiscal space in perspective, as many of the corporations are systemic to the functioning of the country and cannot be shot down in case of economic problems.

While the management of financial assets leaves little to be desired, non-financial assets are only partially recorded which derives from the applied modified cash-based accounting. The informal goal of maintaining 10% liquidity of annual expenditure is generally achieved and also explains why there are no expenditure arrears.

Expenditure control of both payroll and non-payroll expenditures are sound and well-functioning with segregation of duties and underpinned by IT systems with built-in control features. System access controls and user profiles restrict access and audit trails track changes. All payment of invoices and salaries are done by electronic transfer to registered ID verified legal persons, or personal accounts. Notwithstanding, internal audit does not attain sufficient coverage of expenditure and professional standards for internal audit; and the lack of follow-up by auditees and management poses a challenge.

Revenue administration and accounting are well managed and without leakage supporting predictability of in-year resources. Revenue is collected directly into accounts under the consolidated control of the Treasury, which means the MoF has real-time access to the tax revenue balance.

Procurement management has developed with new legislation for procurement of goods and services defining open competition as default with few exceptions. The two websites with tender information on goods services and works are about to be unified. Information on upcoming tenders is announced as well as contract awards. The overriding challenge is the lack of procurement statistics as there is no procurement database for all procurement or oversight, which deprives the GoG of important expenditure information. The decentralised procurement system is no excuse for not recording all procurement given the capacity of the financial management system PRISME. With the adoption of Inatsisartutlov no. 7 of 12 June 2019 on the Complaints Board for Public Procurement there is now legal foundation for redress comprising all types of procurement and with a Board composition included independent legal and technical expertise. Complaints and decision are published on the Consumer and Competition Agency’s website[6]

Financial data integrity is robust with the integration of the main IT systems in ERP. The number of bank accounts has been reduced by 43% to 108 compared to the PEFA 2014 report and account reconciliation is done monthly, though the Audit Protocol for 2020 found that some smaller bank accounts had not been continuously reconciled during the year. Access to records and changes to data in the IT systems is restricted, recorded and results in audit trails. However, there is no designated body to review IT data integrity and no periodic lists of users are produced for management review.

In-year budget execution reports have improved in terms of timeliness and content and are now published quarterly on the MoF website. The quarterly reports allow direct comparison with the original budget and the supplementary appropriations with explanatory annotations supplemented with an overview of liquidity.

The annual financial statements prepared by the Treasury in three dimensions: administrative, functional (Formål), and economic (Art) are submitted within six months to the accounting firm (Deloitte) appointed as the external auditor. Greenland has opted for this solution, instead of a supreme audit institution for cost-efficiency reasons. The external auditor is appointed by the Inatsisartut every year to ensure independence of the GoG. The external auditor carries out the audit comprising: financial, compliance and performance audit according to international standards, though the performance audit seems lite. The audit report for the years assessed have been unqualified and without adverse opinions, but with observations and recommendations on issues that warrant attention.

The legislative scrutiny of the annual audit reports and protocols is comprehensive and transparent with the public informed about the two hearings prior to approval. The Audit Committee reviews the audit report and prepares a report that mirrors the observations recommendations made by the external auditor and adding the Audit Committee’s own observations. This report is then tabled for hearings in Inatsisartut before approval. Follow-up on the audit observation is systematic and done by both the external auditor and the Audit Committee, with status reported in the annual audit protocols.

2.2 Impact of PFM performance on three main fiscal and budgetary outcomes

- Aggregate fiscal discipline

Although the budget documentation submitted to the parliament is very comprehensive, it fails to give an overview of the extent the current economic situation has influenced budget decisions. Moreover, the macro-fiscal information for the three forward years in the Finance Acts is fairly unsophisticated and without mention of assumptions, alternative scenarios and outcomes. Nevertheless, budget discipline is robust and is mandated by law as maintaining a balanced budget over a 4-year period. For the years assessed revenue has surpassed expenditure.

- Strategic allocation of resources

The main objective of PEFA and PFM reform is to support sustainable development and better and more effective service delivery outcomes that meet the population’s needs and priorities.

A prerequisite for strategic resource allocation requires plans for frontline sectors such as health, education and labour underpinned by indicators, results and outcomes. While this is the case for education sector and to a limited extent in the health sector, the majority of ministries do not publish either comprehensive plans nor a systematic set of indicators linked to outputs or outcomes.

- Efficient use of resources for service delivery

Efficient service delivery is supported by good domestic revenue mobilization and administration, seamless financial management processes and good liquidity ensuring that the budgeted funds are timely available to provide services. Payroll control is good backed by the integration of personnel data with payroll, segregation of duties when changes are made and monthly payroll lists verified by budget units; and payroll audit is annually by the external auditor. Control of non-payroll expenditure is equally reassuring, confirmed by the external auditor.

Procurement monitoring is an area that merits improvement in terms of recording and oversight of the decentralized procurement setup. A centralized registry needs to be put into place which in turn would enable performance audits to be carried out and also contribute to an improved ability to monitor and oversee overall procurement at central and municipal level.

External accountability for financial management is compatible with best practice with annual financial statements thoroughly audited (financial, compliance and performance) by Deloitte within 6 months of the end of the fiscal year. The scrutiny by Inatsisartut is equally thorough, transparent and timely with an active Public Accounts Committee and public hearings.

2.3 Performance change since previous assessment

Comparison between the 2014 and 2021 is guided by the PEFA Secretariate note[7]. It is not possible to make a direct comparison between the current assessment (which uses the PEFA 2016 framework) and the previous assessment undertaken in 2014 (which used the 2011 version of the framework). The report, therefore, includes an additional analysis that compares performance at this time using the same version of the framework used in 2014. This assessment is presented at annex 6.

Figure 2.1: Comparison of distribution of indicator scores between assessments in 2014 and 2021

Note: Comparison carried out utilizing the PEFA 2011 assessment framework

Figure 2.1 presents the comparison of the distribution of scores between the previous PEFA assessment in 2014 with the current PEFA assessment in 2021 using the 2011 framework. Overall, comparison of current performance with the performance assessed in 2014 shows that 10 indicators have improved, 5 declined, and 13 stayed the same signifying commendable performance.

Figure 2.2 highlights the changes by indicator. A more detailed explanation of variations for indicators and dimensions is presented in Annex 6. Since the last PEFA in 2014 Greenland has been implementing a PFM action reform plan which has been updated to include 2021.

In the area of Credibility of the budget PI-1 to PI-4 two indicators (PI-1 and PI-4) are unchanged while PI-2 has declined due to increased variability in 2020 in the outturn compared to the budget while improved improvements in revenue forecasting has led PI-3 to improve.

Figure 2.2: Comparison by indicator score between assessments in 2014 and 2021

Note: Comparison carried out utilizing the PEFA 2011 assessment framework

In the area of Comprehensiveness and transparency the PI-7 is unchanged. PI-5 has declined as capital expenditure is not budgeted on the economic classifier. Indicators PI-6, PI-8, PI-9 and PI-10 have all improved. PI-6 because the content of budget information has improved, PI-8 due to the implementation of a new governmentwide ERP system, PI-9 is improved due to the new fiscal risk report produced by GoG and PI-10 has improved as public access to key fiscal information has improved.

In the area of the Budget cycle:

- C(i) Policy-based budgeting: PI-11 is unchanged while the score of PI-12 has declined due to a decline of the grading of multi-year fiscal forecasting. In the area of the Budget cycle;

- C(ii) Predictability and control in budget execution: The grading of indicators PI-13, PI-14, PI-16 and PI-17 is unchanged. Indicators PI-15, PI-18, PI-19 and PI-20 have improved. PI-15 has seen an improvement in the monitoring of tax arrears. PI-18 has been upgraded due to the implementation of the new ERP that has improved payroll controls. PI-19 has improved due to the implementation of a new Procurement complaints mechanism and PI-20 has improved as the new ERP has improved the control environment. PI-21 has declined as performance of internal audit has declined; and

- C(iii) Accounting, recording and reporting:PI-23 has improved as the ERP provides for more efficient reporting on ressources allocated to service delivery, PI-24 and PI-25 remain with the same grading while the grading of PI-22 has declined as suspense accounts are not cleared on a monthly basis.

In the area of External scrutiny and audit PI-26, PI-27 and PI-28 remain with the same grades.

One major step forward has been the implementation of a new ERP system covering central government and the 5 municipalities with the last municipality enrolled in September 2021. The ERP implementation includes the implementation of a uniform CoA across central government and sub national entities (municipalities). This implementation has been the backbone of many of the improvements in indicator scores.

The PFM reform action plan comprises several areas, sector planning and costing, development and transparency of municipal financial management, internal controls and procurement which are all areas that have seen progress as measured by the indicators.

[3] GDP in current prices

[4]https://naalakkersuisut.gl/~/media/Nanoq/Files/Attached%20Files/Finans/DK/Oekonomisk%20raad/GOR_ny/GØR%20rapport%202020%20da.pdf

[5] However, these figures are not uncommon is small economies. GØR, autumn 2020, p. 33

[7] PEFA Secretariate: PEFA 2016: Guidance on tracking PFM performance for successive assessments (https://www.pefa.org/sites/pefa/files/resources/downloads/Tracking%20PF…)