Year in Review

This section focuses on the Public Expenditure and Financial Accountability (PEFA) assessments finalized in 2019 and gives a high-level overview of public financial management (PFM) performance in the countries under review. It highlights three countries (Argentina, Ethiopia, and Ukraine) and one territory (West Bank and Gaza) that finalized a PEFA assessment in 2019, providing an overview of their performance and a comparison with other countries or territories in their region.

Key Messages

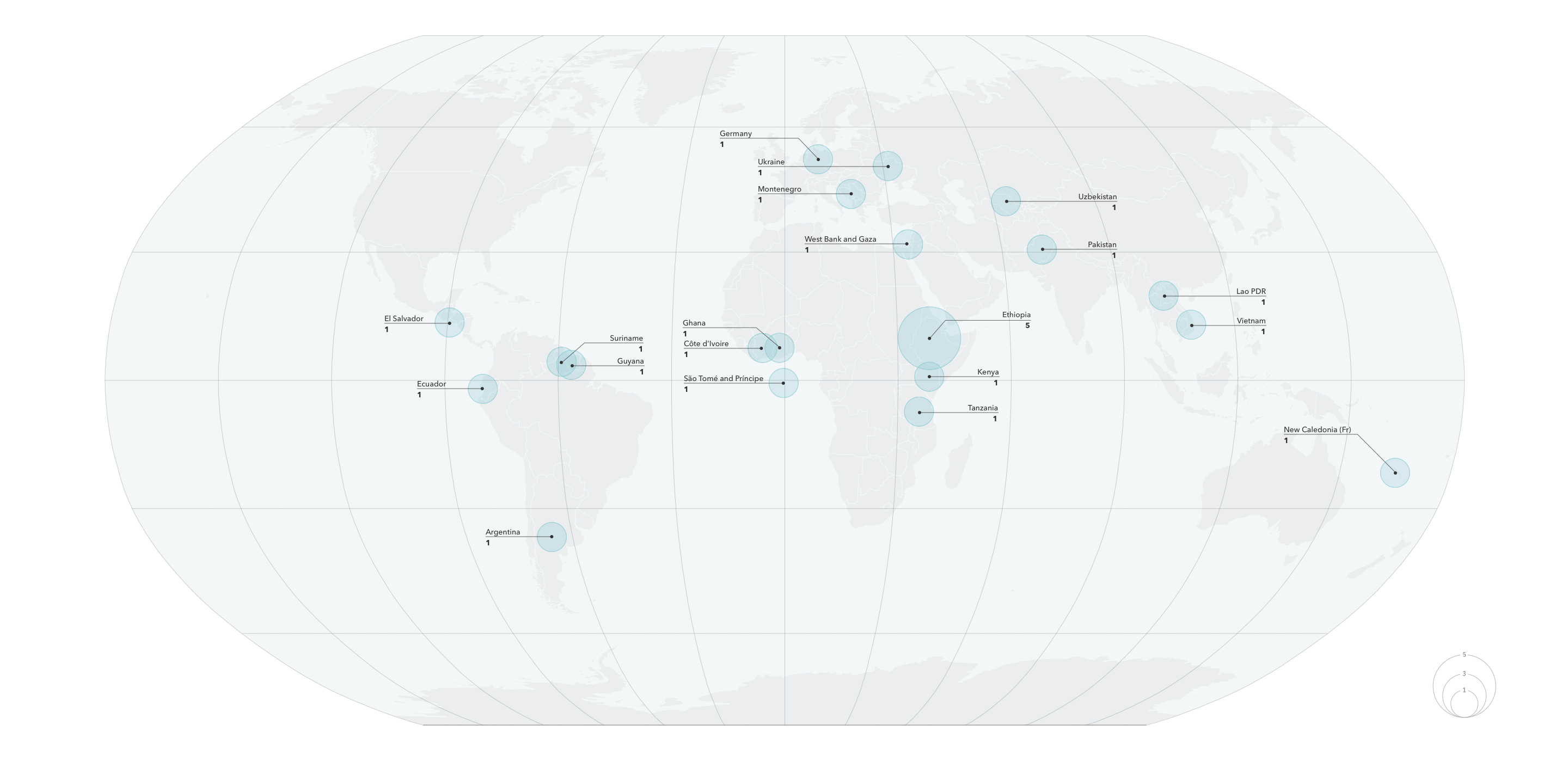

- There were 28 PEFA assessments finalized in 2019, comprising 16 assessments at the national level and 12 assessments at the subnational level.

- The majority of assessments were repeat assessment (this means that previous assessments were conducted); however, Argentina had its first national PEFA assessment (there were, however, previous PEFA assessments at the subnational level in Argentina) and Germany had its first PEFA assessment at the subnational level.

- Ukraine was the first country with a repeat assessment using the PEFA 2016 methodology; its PFM system showed improvements in many aspects of PFM, but there were some weaknesses in the management of fiscal risks and integrity of financial data.

- In the sample of 16 national assessments, average PFM performance did not change significantly compared to the sample national assessments conducted between 2016-18.

A growing number of governments are taking ownership of the assessment process and are writing the reports themselves or partnering with a development organization to carry out the assessment.

This section highlights the following PEFA assessment reports:

Argentina

The 2019 assessment was the first PEFA assessment for Argentina and was managed and funded by the World Bank.

Ethiopia

The 2019 assessment was the fourth PEFA assessment for Ethiopia at the national level. Previous assessments were conducted in 2007, 2010, and 2015. It was managed by the World Bank and funded by the World Bank, Irish Aid, the United Kingdom’s Department for International Development (DFID), the European Commission, the United Nations Children’s Fund (UNICEF), and UN Women. Several subnational assessments analyzing the relationship between PFM performance and service delivery were also carried out, as was an assessment in cooperation with UN Women analyzing the gender responsiveness of PFM systems.

Ukraine

The 2019 assessment was the fourth PEFA assessment for Ukraine at the national level, with previous assessments conducted in 2007, 2012, and 2016. It is the second PEFA assessment in Ukraine that used the PEFA 2016 framework, which makes Ukraine the first country globally for which the PEFA 2016 methodology can be used to compare performance over time. The assessment was managed by the World Bank and funded by the European Commission.

West Bank and Gaza

The 2019 assessment was the third PEFA assessment for West Bank and Gaza. The previous two assessments were conducted in 2007 and 2013. The assessment was managed by the World Bank and funded by the European Commission and the government of Denmark.

The analysis of selected countries or territories is drawn from the PEFA assessment reports and is accompanied by charts using the PEFA 2016 methodology. For regional comparisons, only countries that were assessed with the PEFA 2016 methodology are included.

MAP OF PUBLIC EXPENDITURE AND FINANCIAL ACCOUNTABILITY (PEFA) ASSESSMENTS 2019

Argentina

The PEFA assessment found that Argentina’s PFM system is reasonably aligned with international standards and good practices.

For the full report, visit PEFA's website.

In particular, the “transparency of public finances” pillar is advanced, and the “policy-based fiscal strategy and budgeting” pillar shows solid performance. While the “budget reliability” and “accounting and reporting” pillars are slightly above the basic level of performance, two pillars (“management of assets and liabilities” and “predictability and control in budget execution”) show mixed results. Finally, the “external scrutiny and audit” pillar is found to underperform.

Assessments Metrics

| Type | National |

| PEFA assessment | First |

| Report date | 4-Dec-19 |

| PEFA check | Yes |

| Period of analysis | 2016, 2017, 2018 |

| Lead agency | World Bank, Argentine government |

| Other agencies | - |

| Number of A grades | 3 |

| Number of B or C grades | 23 |

| Number of D grades | 5 |

Pillar 1: Budget Reliability

The budget at the national level in Argentina shows deviations between planned and real spending at the aggregate level (PI–1). The deviations are attributable, according to official sources, mainly to economywide inflation rates, which have been much higher than originally projected. Revenue estimates at the aggregate level, but also disaggregated by type of revenue, show important differences with actual revenue collections (PI–3). The deviations show that the government is underestimating revenue projections, both at the aggregate and disaggregated levels.

Pillar 2: Transparency of Public Finances

The documentation submitted to the legislature (PI–5) to support the scrutiny of the budget proposal is generally complete and allows for an exhaustive examination of central government macrofiscal forecasts and changes in policy priorities from previous years. All central government revenue and expenditure operations are adequately reported in ex post financial reports (PI–6). Transfers to subnational governments, at the provincial level, are determined by an adhered-to rules-based system, and transfer ceilings are communicated to provincial governments in time for them to complete their budget planning and formulation in detail (PI–7). Information on performance in service delivery is produced regularly, presented to the legislature, and made public at the formulation and execution stages of the budget cycle, disaggregated by program (PI–8). Public access to fiscal information is considered to be good practice (PI–9).

Pillar 3: Management of Assets and Liabilities

Management of public assets and liabilities at the national level in Argentina is still in the process of assimilating and adjusting to international good practices. The central government monitors and reports regularly on fiscal risks and most contingent liabilities.

However, its oversight role is heavily compromised by the limited amount of timely and relevant information that is available from public corporations and subnational governments (PI–10). Most major public investment projects are assessed using robust appraisal methods, but reports are not formally published. There is no rigorous and transparent arrangement for prioritizing and selecting projects included in the budget, nor is there registration of forward-looking capital and recurrent costs that are likely to be incurred over the life of the investment (PI–11).

“There is no rigorous and transparent arrangement for prioritizing and selecting investment projects.”

The central government keeps records of all financial assets, but assets are not recognized at a fair or market value and the portfolio’s performance is not published. Records of nonfinancial assets are kept centrally but not reconciled with existing physical inventories. Reports that disclose their use and age profile are not published or available (PI–12). Records of domestic and foreign debt and loan guarantees are complete, accurate, updated, and reconciled monthly. These records and statistical information are published quarterly. The Ministry of Treasury has yet to finalize and publish a medium-term debt management strategy covering existing and projected government debt with a three-year horizon (PI–13).

Pillar 4: Policy-Based Fiscal Strategy and Budgeting

The Ministry of Treasury prepares annual forecasts for key macroeconomic indicators that support budgetary assumptions. However, there is no formal third-party review of these forecasts (PI–14). The government has a well-publicized fiscal strategy, which is the foundation of the stand-by arrangement signed with the International Monetary Fund (PI–15).

The government prepares a multiannual budget that presents estimates of expenditure for the budget year and two fiscal years into the future, disaggregated by administrative, economic, functional, and program classifications. However, sectoral medium-term strategic plans are not fully costed and, thus, not yet sufficiently aligned with multiannual budgets (PI–16). The annual budget process is organized around a fixed calendar that provides institutions with sufficient time to prepare their budget proposals in detail (PI–17). The legislature has more than two months to examine and approve the budget proposal; the scrutiny of the budget is comprehensive and follows well-established procedures (PI–18).

“The annual budget process is organized around a fixed calendar that provides institutions with sufficient time to prepare their budget proposals.”

Pillar 5: Predictability and Control in Budget Execution

The indicators that measure predictability and control of budget execution at the national level in Argentina show mixed performance regarding their alignment to international standards and best practices. This mixed performance indicates important weaknesses in the PFM system.

Revenue administration in Argentina has room for improvement. Risk management is becoming gradually more systematic, comprehensive, and structured. However, voluntary compliance is weak, which has an adverse impact on revenue audits and investigations (PI–19). The practice of bank and cash balances is solid (PI–20). Budgetary units are able to plan and commit expenditure for at least six months in advance. However, the legislature frequently approves significant in-year adjustments to the budget. Although these adjustments follow the rules and regulations established for this purpose, they risk affecting service delivery (PI–21).

Stocks of expenditure arrears are above the limits that constitute international good practice, and information is not disaggregated by type, age, and composition of expenditure (PI–22). Payroll controls are reasonably well aligned with international good practices and being strengthened continually (PI–23). Procurement management recently has been extensively overhauled, but most changes have not been fully implemented (PI–24). Internal controls of expenditures are mostly adequate (PI–25). Internal audit is operational for all central government entities. However, these audit reports focus primarily on financial compliance (PI–26).

“Stocks of expenditure arrears are above the limits that constitute international good practice, and information is not disaggregated by type, age, and composition of expenditure.”

Pillar 6: Accounting and Reporting

PFM data integrity is high, and access to and changes in revenue and spending records are subject to strict security protocols and result in an audit trail. However, bank accounts and advance payments are reconciled only partially and are generally outside the time frame considered to be good practice (PI–27). In-year budget reports are produced regularly, cover all central government entities, and allow for direct comparisons between execution levels and the original budget approved by the legislature (PI–28). The annual financial reports prepared by the National Accounting Office are complete and comprehensive in their coverage and fully comparable with the approved budget. National accounting standards, however, are still not fully consistent with International Public Sector Accounting Standards (IPSASs) (PI–29).

“Annual financial reports are complete and comprehensive.”

Pillar 7: External Scrutiny and Audit

In Argentina external scrutiny and audit of public finances at the national level are not sufficiently aligned with international good practices. National auditing standards are compatible with International Standards of Supreme Audit Institutions (ISSAI), but coverage of audits, timely submission of reports, and follow-up on recommendations or observations in audit reports are not properly assessed because relevant and adequate information is missing (PI–30). Legislative scrutiny of the audit reports for the last three completed fiscal years has not yet been undertaken (PI–31).

“External scrutiny and audit of public finances at the national level are not sufficiently aligned with international good practices.”

Ethiopia

The 2019 assessment was the fourth PEFA assessment for Ethiopia at the national level.

Previous assessments were conducted in 2007, 2010, and 2015. Concurrent with the PEFA national assessment, several subnational assessments were carried out that reviewed the relationship between PFM performance and service delivery and assessed the gender responsiveness of PFM systems in cooperation with UN Women.

On the basis of the 2011 method, between the 2015 and the 2018 assessments, Ethiopia has more deteriorations in performance (seven) than improvements (three). Fifteen indicators are the same, and six are not comparable.

Assessments Metrics

| Type | National |

| PEFA assessment | Fourth |

| Publication date | 13-Nov-19 |

| PEFA check | Yes |

| Period of analysis | 2016, 2017, 2018 |

| Lead agency | Ethiopian government, World Bank |

| Other agencies | Irish Aid, United Kingdom's Department for International Development, European Union, UNICEF, and UN Women |

| Number of A grades | 3 |

| Number of B or C grades | 24 |

| Number of D grades | 4 |

Pillar 1: Budget Reliability

At the aggregate level, the federal government budget is credible. This is as a result of the tight macrofiscal framework approved by the Council of Ministers, which sets the tone for expenditure management. However, the administrative and economic allocation of expenditures is problematic, as virements across sectors make the budget approved by parliament less credible, leading to poor service delivery (PI–1 and PI–2). The revenue budget (PI–3), especially with regard to composition, is poor, even though the aggregate appears to be reasonable. Some socioeconomic factors account for this poor performance in budget reallocations. During the period under review, 8.5 million Ethiopians were affected by political unrest, which led to a change in political leadership and major budget reallocations, and by drought, which caused a significant drop in government revenues.

Pillar 2: Transparency of Public Finances

Ethiopia’s budget classification system is relatively strong (PI–4). Budget documentation provides some basic elements but is not comprehensive (PI–5). Detailed financial reports of most extrabudgetary units are submitted to government annually within six months of the end of the fiscal year (PI–8). The system for allocating horizontal transfers to regional governments is rules based and transparent (PI–7). Public access to fiscal information is poor (PI–9).

“Public access to fiscal information is poor.”

Pillar 3: Management of Assets and Liabilities

Monitoring of public corporations and regional governments is weak, and the federal government does not prepare and publish a fiscal risk report (PI–10). There is no independent economic analysis of all major capital investment projects. Project costing is weak; only total capital investment cost is provided. There is no forward-linked recurrent expenditure framework in relation to capital investment projects (PI–11). Asset management is relatively weak as well. Although the federal government maintains records of its cash and bank balances, there are no records of other financial assets, such as government equity shares in both public and private enterprises. The federal government does not maintain a consolidated register of its fixed assets; however, individual budget units do keep asset registers (PI–12). A current medium-term debt strategy covering 2016–20 has been prepared and published (PI–13).

Pillar 4: Policy-Based Fiscal Strategy and Budgeting

Policy-based fiscal strategy and budgeting work well as far as the medium-term fiscal framework (MTFF), budget preparation, and legislative scrutiny of the budget are concerned. The Fiscal Policy Directorate prepares forecasts of key macroeconomic indicators, which, with the underlying assumptions, are included in the budget documentation submitted to the legislature (PI–14). A fiscal strategy has not been prepared (PI–15). Although the government prepares a five-year MTFF that is updated annually, the budget is not prepared on a medium-term basis (PI–16). A clear annual budget calendar exists and is generally adhered to; budgetary units have six weeks from receipt of the circular to complete meaningful estimates on time (PI–17). The legislature’s review covers fiscal policies and aggregates for the coming year as well as the details of expenditure and revenue, but the medium-term fiscal framework is not examined (PI–18).

“There is a disconnect between the medium-term fiscal framework and the annual budget.”

Pillar 5: Predictability and Control in Budget Execution

Both revenue management and accounting for revenues are reasonable. Public access to taxpayer information is reasonable (PI–19 and PI–20). Most budget units receive a quarterly expenditure commitment ceiling. Budget reallocations across votes are less frequent, even though sectorwide reallocations are rampant (PI–21). Expenditure arrears are monitored regularly (PI–22). While the public procurement framework is adequate, important procurement information is not made public (PI–24). Internal controls generally are reasonable; however, concerns have been raised in the area of compliance with rules and regulations (PI–25). Internal audit coverage is wide, across most budget units, but adherence to internal standards needs to be improved. Most planned internal audits are carried out (PI–26).

“Important procurement information is not made public.”

Pillar 6: Accounting and Reporting

The integrity of financial data is a concern (PI–27). While most budget units submit monthly reports to the finance ministry, these reports are not consolidated for management’s use (PI–28). Annual financial statements are submitted to the Office of the Federal Auditor General (OFAG) within six months after the end of the financial year. The statements are prepared using a modified cash basis of accounting; they are consistent over time and in line with the government’s legal framework. The statements are comparable with approved budgets and contain information on revenue, expenditure, liabilities, and financial assets (PI–29).

Pillar 7: External Scrutiny and Audit

External audits are in line with ISSAIs, and audit coverage is wide (PI–30). Legislative review and scrutiny of audit reports are good, but enforcement of the recommendations in audit reports is weak (PI–31).

Ukraine

The 2019 PEFA assessment in Ukraine was conducted to provide the government with an objective assessment of the progress made in PFM performance since the previous assessment in 2016. The Ukraine PEFA report is the first report to track changes in performance using the 2016 PEFA framework.

For the full report, visit PEFA's website.

Since the last PEFA assessment, overall reforms across Ukraine’s PFM system have proceeded gradually and progressively. Specifically, the government has made progress in (a) implementing medium-term budget planning; (b) integrating IPSASs into Ukraine’s statutory framework and adopting the 2025 public sector accounting strategy; (c) improving macroeconomic and budget forecasting tools; (d) increasing transparency in PFM through the introduction of an open budget portal; (e) managing fiscal risk, and (f) gradually introducing a gender-oriented approach to budgeting.

“The 2019 Ukraine PEFA report is the first report to track changes in performance using the 2016 PEFA framework.”

Assessments Metrics

| Type | National |

| PEFA assessment | Fourth |

| Publication date | 20-Nov-19 |

| PEFA check | Yes |

| Period of analysis | 2016, 2017, 2018 |

| Lead agency | Government, World Bank |

| Other agencies | European Commission, Swedish International Development Agency (SIDA), and United States Treasury |

| Number of A grades | 10 |

| Number of B or C grades | 17 |

| Number of D grades | 4 |

Pillar 1: Budget Reliability

The challenges in producing accurate projections of total revenue have been met in recent years. Actual revenue has been close to estimated total revenue overall, but projected composition has been is slightly less accurate. This overall result has been achieved in the context of strengths in virement and two adjustments to the Annual Budget Law. The process of controlling budget allocations to match the availability of cash has been supported by good cash forecasting and certainty in the availability of funds for budgetary units to execute their budgets as planned.

“Robust cash forecasting has allowed budget allocations to match available cash.”

Pillar 2: Transparency of Public Finances

Ukraine has a good array of information regarding the finances of budgetary central government. The Chart of Accounts, which underpins budget preparation, execution, and reporting, is comprehensive and consistent with Government Finance Statistics (GFS) standards (PI–4). As a result, budget documents include all of the basic and much of the supplementary information required to support a transparent budget process (PI–5). Data regarding the operations of public bodies are complete in the budget documentation, apart from information on the three social security funds (PI–6). The transfers to subnational government are determined transparently (PI–7). Information on planned and achieved performance in service delivery outputs and outcomes across government sectors is very good, including performance plans, performance achieved, and performance evaluations (PI–8). Public access to fiscal information is strong (PI–9).

“Public access to fiscal information is strong.”

Pillar 3: Management of Assets and Liabilities

Fiscal risk reporting needs to be stronger (PI–10). Unaudited reports on the majority of municipalities are produced annually, with delays of up to nine months. A comprehensive and inclusive process for managing public investment programs and assets is lacking (PI–11 and PI–12). Public assets management is good, but information on the use and age of nonfinancial assets is not complete. Management and approval of debt recording are strong, but the debt management strategy lacks both complete borrowing targets and annual reporting to parliament against debt management objectives (PI–13).

“A comprehensive and inclusive process for managing public investment is lacking.”

Pillar 4: Policy-Based Fiscal Strategy and Budgeting

Some, but limited, progress has been made toward a comprehensive medium-term expenditure framework (PI–16). There is good information on the specification and evaluation of key performance indicators. However, this information is not linked to expenditure budgeting in a medium-term approach, as the budget is presented for the upcoming year only.

The overall fiscal strategy only focuses on the budget year and does contain objectives to be achieved. There is no reporting against outcomes (PI–15). There are no hard ceilings for budget preparation, and the use of costed sector strategies for budget formulation is the exception rather than the norm.

“The legislature has sufficient time to carry out its scrutiny and approves the budget on time.”

All of this activity is carried out in the context of strong macroeconomic and fiscal forecasting (PI–14). There is a budget calendar, but it does not provide budgetary units with adequate time (less than four weeks) to prepare their budgets (PI–17). The legislature has sufficient time to carry out its scrutiny function and approves the budget on time. Nevertheless, the legislature only considers fiscal policies and aggregates for the upcoming budget year, not the medium term. The procedures and timetable for budget scrutiny have not been adhered to in the most recent passed budget (PI–18).

Pillar 5: Predictability and Control in Budget Execution

The taxation system is based on comprehensive legislation providing information on the tax liabilities of taxpayers with respect to obligation and redress, along with a three-tier appeal system that guarantees independence from the administration. A comprehensive risk-based approach to administering revenues is lacking that could be used to determine audit planning (PI–19). Revenue collected is relatively well managed in terms of the flow of funds to the treasury and recording of transactions (PI–20).

Each budgetary agency is responsible for maintaining its own payroll accounting system, but information on employees, which is accounted for by the human resource unit, and their remuneration, which is accounted for by the accounting department, are not reconciled (PI–23). The public procurement system scores well (PI–24), but only 78 percent of purchases are carried out by competitive methods. Overall, the high score reflects the ProZorro electronic procurement system, which is recognized internationally and has received several awards.

“Only 78 percent of purchases are carried out by competitive methods.”

Internal controls on nonsalary expenditure score well, with effective commitment controls and compliance with payment rules and procedures (PI–25). The internal audit function is being developed. Coverage is good overall, although smaller units suffer from staff shortages. Internal audit activities focus primarily on compliance, with some assessment of efficiency (PI–26).

Pillar 6: Accounting and Reporting

Accounts reconciliation and financial data integrity are areas of strengths (PI–29). The coverage and classification of data included in in-year budget reports allow for direct comparison to the original budget. There are no material concerns regarding the accuracy of data (PI–28). The annual financial statements include complete information on assets, liabilities (including long-term liabilities), revenue, and expenditure and a reconciled cash statement. They are submitted for external consumption within three months after the close of the reporting year. The public sector accounting regulations (national standards) that apply to all financial statements are largely consistent with international standards (PI–29).

Pillar 7: External Scrutiny and Audit

External audit is an area of significant strength (PI–30). The financial statements are audited using standards based on ISSAIs. The financial audit and (few) performance audits that are carried out enable the evaluation of the timeliness and completeness of budget revenues, productivity, performance, and efficiency of using budget funds. The audit reports highlight significant problems and identify relevant material issues and systemic and control risks. Legislative scrutiny of audit reports is good, particularly regarding the timing of audit report scrutiny and transparency of the scrutiny process. However, hearings of audit findings and follow-up of audit recommendations issued by parliament need to be stronger (PI–31).

“The audit report highlights systemic and control risks.”

West Bank and Gaza

The 2019 assessment was the third PEFA assessment for West Bank and Gaza; two previous assessments were conducted in 2007 and 2013. The assessment was managed by the World Bank and funded by the European Commission and the government of Denmark.

For the full report, visit PEFA's website.

Fiscal discipline in West Bank and Gaza is very reasonable, especially in the context within which the government has to operate, and most elements of the PFM system contribute to this outcome. On the expenditure side, aggregate estimates are reasonable (PI–1, rated B). However, differences between the original estimates and the composition of actual expenditures are large (PI–2.1 and PI–2.2), and actual expenditures are distorted due to expenditure arrears, which have been increasing in recent years (PI–22).

In terms of revenue, estimates are not accurate (PI–3, rated C), mainly because promised donor commitments failed to materialize, but also because forward estimates of the monthly transfer of “clearance revenues” were limited (collected by the government of Israel on goods and services destined for West Bank and Gaza). The government is heavily dependent on donor resources, and fluctuations in these funds are unpredictable, which has been a constant challenge for fiscal management. The clearance revenues constitute about two-thirds of the government’s budgetary revenue, and the flows have been unpredictable. However, the accounting arrangements—by necessity—are sound (PI–20).

“The government is heavily dependent on unpredictable donor resources, which has been a constant challenge for fiscal management.”

A PEFA assessment also recognizes broader issues that may affect fiscal discipline. For example, the monitoring of financial risks is weak (PI–10). Similarly, in part because donors often take a leading role in public investment, the management of both public investments and public assets is weak (PI–11 and PI–12, both rated D+). The budget documents have a very limited medium-term perspective, but medium-term projections do inform the internal process. In view of the uncertain fiscal environment, the presentation of medium-term projections in the documents would be valuable (PI–16, rated D).

For aspects related to efficiency in the use of resources, the PFM system is reasonable, as shown by the indicator for predictability of resource allocation (PI–21, rated C+); financial relationships between agencies are partially transparent (PI–7, rated C), as many services are decentralized to the districts to serve local residents; and the score for “performance information” is good (PI–8, rated B).

Finally, the monitoring mechanisms in place show mixed results. As no functioning legislature was in place during the three-year assessment period, PI–31 could not be rated. However, the Supreme Audit and Administrative Control Bureau (SAACB) has full legal, financial, and administrative independence as well as unrestricted access to records, documentation, and information.

Assessments Metrics

| Type | National |

| PEFA assessment | Third |

| Publication date | 20-Jun-19 |

| PEFA check | Yes |

| Period of analysis | 2015, 2016, 2017 (financial years) |

| Lead agency | World Bank |

| Other agencies | European Commission, Denmark |

| Number of A grades | 2 |

| Number of B or C grades | 17 |

| Number of D grades | 11 |

Pillar 1: Budget Reliability

The context in which West Bank and Gaza develops its budget is important, as the political situation provides no certainty that the estimates will prove to be reliable. In the three years reviewed, the PFM system developed reasonable estimates of aggregate expenditure, although the difference between actual expenditure and the initial budget estimate was high in the first of these years. In addition, there is still a large gap between the budget and the composition of actual expenditure (PI–2, rated D+) in both function and economic type. As for revenues, actual receipts are significantly below the level anticipated at the beginning of the year (PI–3, rated C), this situation is exacerbated further by the unpredictable treatment of “tax clearance deductions” by the Israeli authorities.

Pillar 2: Transparency of Public Finances

With the exception of the financial information available to citizens (PI–9, rated C), the government is transparent in the management of its public finances. Budget documents are comprehensive and closely follow GFS and Classification of the Functions of Government (COFOG) requirements. Coverage of government activities is comprehensive, although the focus does not extend beyond the budget year. All subnational entities within West Bank and Gaza comply with financial reporting requirements (PI–7, rated C), although no comprehensive report of their activities is published. However, performance indicators have been developed for many services and are available to citizens (PI–8, rated B).

Pillar 3: Management of Assets and Liabilities

Mechanisms for monitoring fiscal risks are weak (PI-10, rated ‘D’). There are no formal guidelines for project appraisal and most investment projects are selected according to government priorities, although individual ministries may undertake their own appraisals. However, externally financed investment projects are monitored and evaluated. There are no forward-linked recurrent expenditures for investment projects, and the legal framework for managing both public investments and public assets is weak (PIs-11 and 12, both rated ‘D+’): in addition, very limited information is made available to the public, although any proceeds from assets disposal is reported in in-year budget reports.

“Mechanisms for monitoring fiscal risks are weak.”

Pillar 4: Policy-Based Fiscal Strategy and Budgeting

The Annual Budget Law presented to the president includes a table of key economic indicators covering the four prior years, the budget year, and the following four fiscal years, as well as fiscal forecasts for the budget year and comparable information for the preceding three years. Forecasts are disaggregated, but there is no assessment of the main changes since the prior year. Although the Ministry of Finance and Planning (MoFP) considers policy developments and significant risks, these are not included in the annual law or accompanying documents (PI–14 and PI–15, rated D+ and C, respectively).

Although information is prepared for the budget year and the next two fiscal years, the Annual Budget Law only incorporates information for the budget year. Medium-term expenditure ceilings are approved by the Council of Ministers before the second circular is issued (PI–16.2, rated D), but there is no explanation of changes to the estimates between the prior-year medium-term budget and the current budget.

“In each of the last three fiscal years, the budget has not been presented until several months after the start of the year.”

Clear budget schedules exist and are complied with, giving budget units at least four weeks to prepare their detailed estimates following the notification of ceilings in the second budget circular. The MoFP circulars provide extensive guidance to ministries for budget preparation and indicate approved ceilings. In each of the last three fiscal years, the budget has not been presented until several months after the start of the year (PI–17, rated C). The president signs the Annual Budget Law two to three months after the new fiscal year has started, although there are clear rules for in-year budget reallocations within the approved total (PI–18.4, rated B.

Pillar 5: Predictability and Control in Budget Execution

The MoFP website contains up-to-date and comprehensive taxpayer information, including laws and tax administration procedures for registration and filing of tax returns. While there is no independent tax appeals board, the law courts follow an administrative (internal) process for redress (PI–19.1, rated A). The MoFP receives both monthly and daily revenue reports that include a variance analysis with the reasons for deviations. All revenue collections are transferred to the treasury’s main account within 24 hours (PI–20.2, rated A), and cash balances are consolidated every day to ensure zero balances (although the Donor Fund Account is outside this process). The cash position is monitored on a daily basis, and the cash plan is updated monthly; however, a permanent cash-rationing process is in place.

The stock of expenditure arrears was more than 10 percent in each of the last three completed fiscal years: the MoFP generates a monthly report within two weeks of the end of the previous month (PI–22.2, rated A). The expenditure management process prescribes clear procedures that segregate duties and responsibilities of staff within the payment process. The Integrated Financial Management Information System limits expenditure commitments to approved quarterly budget allotments (ceilings) but does not limit commitments to the actual cash available.

“At least 80 percent of internal audit plans are implemented, and the majority of recommendations are addressed within three to six months.”

Most line ministries have functional internal audit units, which are largely financial and focused on compliance. At least 80 percent of internal audit plans are implemented, and the majority of recommendations are addressed within three to six months. Follow-up and corrective strategies are a concern. Currently, there is no automatic link between the database of personnel and the payroll, although the payroll is supported by full documentation for all changes made to personnel records each month and is checked against the previous month’s data (PI–23). Open (competitive) bidding is the default procurement method stipulated by the law. Government does not have a procurement monitoring and reporting system for ensuring value for money and promoting fiduciary integrity (PI–24).

Pillar 6: Accounting and Reporting

In-year budget execution reports are comparable with the originally approved budget, and expenditure is reported and aggregated administratively, economically, and functionally; these reports also show transfers to deconcentrated government entities (PI–28, rated B+). The MoFP performs detailed monthly bank reconciliations for at least 95 percent of central government bank accounts within three weeks after the end of the previous month. Most donor fund accounts are also reconciled within two weeks after the end of the preceding month (PI–27, rated B+).

The MoFP is responsible for preparation and fair presentation of the financial statements as set forth by the IPSAS cash basis of accounting and the territory’s legal requirements. There is compliance with meeting the standards, although some deficiencies are noted (PI–30.3, rated B). The issuance of annual financial statements is delayed, and statements are not submitted for external audit within nine months of the end of the fiscal year: no statements were issued for the last three fiscal years (PI–29, rated D+).

“The issuance of annual financial statements is delayed.”

Pillar 7: External Scrutiny and Audit

The SAACB audits all central and local government entities on a regular basis, using a risk-based audit plan according to the priorities defined in the medium-term strategic plan. Most expenditures and revenues are audited using ISSAIs. Audit reports are published within one year but are submitted to the MoFP for comments within nine months of receipt. Formal responses to audit reports are timely, and 80 percent of recommendations are implemented in public entities. The law gives full legal, financial, and administrative independence to the SAACB. The SAACB has unrestricted access to records, documentation, and information (PI–30, rated C+). No functioning legislature has been in place in the last three years (hence PI–31 is not rated).